Invoicing

An invoice (or bill) is simply a document used to ask the customer for money for a product or service that has been provided. However, invoicing must take account of customer experience, the requirements of the tax authorities, and your own business’s need to ensure that you get the money owed to you. Invoices at the same time form the basis for accounting. Any invoicing software should help with all of this.

What is an invoice?

An invoice (or bill) is simply a document used to ask the customer for money for a product or service that has been provided. However, invoicing must take account of customer experience, the requirements of the tax authorities, and your own business’s need to ensure that you get the money owed to you. Invoices at the same time form the basis for accounting. Any invoicing software should help with all of this.

What makes a good invoice?

A good invoice is easy to pay. A goof invoice makes it easy for the customer to check that the billing has been done correctly in all respects. A good invoice must of course meet the requirements of the tax authorities. These pages contains examples of well-made invoices, and a number of things that are important to keep in mind.

Here we have put together a list of tips for making invoices:

Create an invoice on the same day as the transaction was done. One week’s delay in creating the invoice will also delay the payment by a week. Another problem with delays in invoicing is that agreed-upon things might be forgotten. Timely invoicing gives the customer a professional impression of your company.

Draft the invoice in advance as an offer or a sales order at the earliest time possible. The invoicing itself – that is, producing the actual invoice and sending it to the customer – should not take more than a minute.

Be sure to send the invoice the way your customer prefers. As an electronic invoice if the customer prefers so, by email if it has been agreed on, or by conventional mail if you are unsure of the customer’s preference.

Before sending the invoice, double-check that the invoice meets the requirements of the tax authorities and that the name and other details are correct on the invoice. It is the responsibility of the customer not to pay any invoice that is incorrect in some detail or other.

Invoices need to be archived carefully. It is the responsibility of the company to save all accounting materials for a minimum of seven years. Electronic archiving is sufficient, as long as the documents have been saved in at least three different places.

Invoices must never be altered once they have been sent. If it turns out that there was a mistake in the invoice sent to the customer, it needs to be reimbursed and a new one made and sent in its place. If you need to modify a sent invoice be sure to notify your bookkeeper and customer.

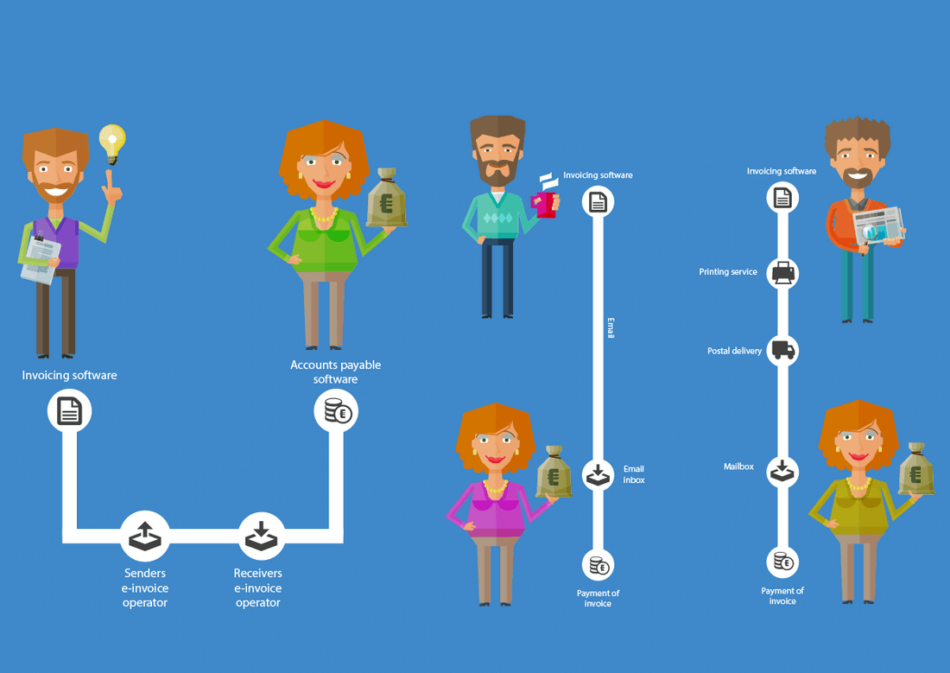

Electronic invoicing

An electronic invoice is any kind of invoice that has been sent from the company to the customer in electronic form. An electronic invoice can therefore be an invoice sent by email, an e-invoice, or a printed invoice that has been sent from an electronic system to be printed and mailed to the customer. The method of delivery of the invoice is decided by the customer, not by the sender of the invoice. An invoice is more likely to be paid on time, if it is sent in the method preferred by the customer. This is another important way in which the company can make a positive impression on the customer.

E-invoicing

An e-invoice is the “proper kind” of electronic invoice. Contrary to the fear mongering surrounding it, they are even easier to send than printed invoices. All you need is the e-invoicing address of your customer and an invoicing service for sending the invoices. E-invoices are popular with companies that want to handle their purchasing invoices electronically: to approve, pay, and send invoices to accounting without manual work. This saves the recipients time, and helps prevent mistakes in processing the invoices.

Invoice via email

Sending invoices by email is for many consumers and small companies a handy way to get the task done quickly. A good-quality invoicing service sends the invoice to the recipient’s email address, monitors the process to ensure that the message gets through, and notifies the sender when the recipient has read the email.

Through the printing service

Another form of invoicing, and one that can be considered intermediate between electronic and printed invoices, is that the invoice is sent electronically but the recipient gets a paper printout on the invoice. This is done by the invoice being sent from the invoicing service to a printing service, from where the printed invoice is then mailed to the customer.